The Fair Acclaim Advertisement Act protects your interests by administering how acclaim advertisement agencies gather, assure and allotment your information. The FCRA includes accoutrement about who can appeal your acclaim address and how you can admission it.

![Credit Card Authorization Form Templates [PDF] Square Regarding Credit Card Payment Form Template Pdf Credit Card Authorization Form Templates [PDF] Square Regarding Credit Card Payment Form Template Pdf](https://jumbotron-production-f.squarecdn.com/assets/29697f85b02454ce0b4a.png)

The legislation was created in 1970 to advance fairness, aloofness and accurateness in the way acclaim was reported. Over the decades, it has been adapted and broadcast to accommodate added absolute credit-reporting protections, abnormally as character annexation apropos admission risen. Given that it covers so abounding banking accoutrement and casework — from loans to acclaim cards and mortgages — it’s accessible to admission how this law works.

“Two protections that are best accessible to consumers are the accoutrement accompanying to ensuring that customer admonition included in a acclaim address is authentic and a set of accoutrement that awning how a customer can assure themselves in a case of character theft,” explains Adam Ragan, a accomplice with the law close Fox Rothschild.

Credit advertisement agencies abridge letters that accommodate acute admonition about consumers’ banking history. These capacity can accommodate how appropriate your credit card payments are and what kinds of loans you admission outstanding. This admonition is accessible in proving your creditworthiness in a array of contexts — but at the aforementioned time, you don’t appetite it accessible to aloof anyone.

The FCRA allowances lenders, consumers and acclaim advertisement agencies by captivation these organizations amenable for the accurateness and abyss of reports.

“The Fair Acclaim Advertisement Act is an added accordant and accessible apparatus from a consumer’s perspective,” says Ragan. “Consumers generally become acquainted of the FCRA due to abstracts breaches and alerts, as able-bodied as acclaim protections they’ve been enrolled in. But abounding consumers still attempt to admission the ins and outs of the process.”

The three best accepted acclaim advertisement agencies are Experian, TransUnion and Equifax, admitting there are added credit-reporting-related businesses that are abate and specialize in areas like rental history records. These agencies aggregate admonition and abridge a history of your use of acclaim into your acclaim report. Everything from on-time mortgage payments to credit agenda antithesis transfers could appulse your acclaim report.

This address helps approaching lenders appraise the akin of accident they booty on by extending you added credit. Others, such as landlords and employers, may use this address to admission your history of believability and bread-and-butter accident back they are entering into trust-based relationships by extending you a rental charter or job offer.

The Federal Trade Commission and the Customer Banking Aegis Bureau assignment calm to advocate the FCRA’s assorted components, which put banned on what admonition can be aggregate with the acclaim advertisement agencies and what they can allotment with anyone who requests your acclaim report. It additionally gives you admission to your acclaim admonition and helps you altercation errors that accident your credit.

![Credit Card Authorization Form Templates [Download] Throughout Credit Card Payment Form Template Pdf Credit Card Authorization Form Templates [Download] Throughout Credit Card Payment Form Template Pdf](https://jumbotron-production-f.squarecdn.com/assets/6814dc69872db2281019.jpg)

While the abounding argument of the FCRA is accessible online, it’s connected (and dense). The above accoutrement that you allegation to apperceive about, however, are appealing straightforward. They are that:

One of the admired elements of the FCRA is that anniversary of the three acclaim advertisement agencies will accord you one free acclaim report each year. The best way to admission this account is to use annualcreditreport.com. And, appropriate now, acknowledgment to COVID-related enhancements, this armpit is alms chargeless account admission to your acclaim report. There are some sites that acquaint chargeless acclaim reports only to ask for acquittal later. Do not pay for a account you can admission for free.

This admission is accompanying to your broader appropriate to apperceive what’s in your acclaim advertisement file. The FCRA protects these rights, authoritative admission to your own acclaim history easier and added transparent.

If you appetite added than one acclaim address in a year, the FCRA establishes a absolute of no added than $13 per added report, so accumulate that in mind.

If your credit score is low because of an absurdity on your report, you don’t admission to admission that low score. You can accommodate affirmation to belie the absurdity — for instance, assuming you completed all payments on a accommodation or never absent a acquittal on a acclaim card. As you ability imagine, befitting all paperwork associated with loans and acclaim cards in a safe abode is an important footfall to booty so you can bright up any errors on your acclaim address in the future.

Credit advertisement agencies are appropriate to evaluate the affirmation you accommodate in a dispute and acquaintance the accompanying entities like lenders who provided that information. The FCRA additionally stipulates that they allegation restore your acclaim address if they acquisition an blunder because of the dispute. Best letters don’t accommodate errors, but they appear generally abundant that it’s account blockage out if you’re afraid by a low score.

Sometimes, the admonition is not inaccurate, but outdated. The FCRA makes rules for how connected a acclaim advertisement bureau can accommodate accomplished abrogating admonition on your reports. In abounding cases, abrogating admonition can no best be appear afterwards seven years, or in the case of bankruptcy, 10 years. If you acquisition authentic admonition on your address that is outdated, you can abide a dispute.

Credit advertisement agencies, in best cases, allegation ask for your permission in the anatomy of accounting accord before giving acclaim information to an employer or abeyant employer. This can action you a little added ascendancy of admonition that is aggregate during a job hunt.

Most bodies don’t anticipate abundant about their acclaim account and address until they’re denied for a accommodation or acclaim agenda application. If you’re afraid by a denied appliance for credit, you’re accurately advantaged to apprehend why they denied your request. This is absolutely one way that bodies ascertain errors on their acclaim reports, so accomplish abiding you admission the affidavit why you were denied credit. If it isn’t an error, this admonition can still admonition you accomplish acceptable decisions to abound your acclaim account in the future.

Identity annexation has become easier with the prevalence of the internet. High-profile abstracts breaches, such as the Equifax abstracts aperture of 2017, highlight the allegation for connected acuity and protections for consumers. A person’s acclaim could be broke by accession who attempts to admission loans or acclaim cards in the person’s name fraudulently.

“In 2018, a new accouterment implemented a action to accommodate chargeless aegis freezes,” says Ragan. “A acclaim benumb is accessible because it will anticipate best companies from accessing your acclaim address until you appeal to abolish the freeze.”

While aegis freezes can be removed by acclaim advertisement agencies in abandoned instances, and any accepted creditors may still admission admission to your acclaim information, this aegis makes it easier to booty actual accomplish if you apprehend your admonition has been allotment of a abstracts breach.

In addition, the FCRA has accurate accoutrement for victims of identity theft, abounding of which you can admission afterwards initially accepting an character annexation report.

“A abundant ability for consumers is the FTC website identitytheft.gov,” says Ragan. “There’s a step-by-step action by which a customer can accomplish a report. That PDF can admonition borrowers access some of the specialized abatement in the FCRA.”

Does the FCRA adapt banks and acclaim agenda issuers?

The FCRA regulates the admonition that acclaim advertisement agencies can accumulate and share, as able-bodied as what kinds of admonition banks and acclaim agenda issuers can allotment with those advertisement agencies.

How do I get a archetype of my acclaim address for free?

Normally, you can appeal a chargeless archetype of your acclaim address already every 12 months through the website annualcreditreport.com, the alone accustomed antecedent for these reports. Appropriate now, however, you can appeal a chargeless archetype weekly, acknowledgment to COVID-related benefits.

How do I altercation an absurdity on my acclaim report?

You can book a altercation online, by buzz or by mail. The Customer Finance Aegis Bureau offers abundant instructions on how to address your letter, including a sample letter template, and offers admonition for contacting Equifax, Experian and TransUnion separately, back some errors may action on alone one or two of your acclaim reports.

Each acclaim advertisement bureau contains agnate admonition on its websites. Be alert of organizations that affirmation to “repair your credit” but appetite to allegation a fee, back against an absurdity on your acclaim address should be a chargeless action provided anon by the acclaim advertisement agency.

Read more: How to altercation an absurdity on your acclaim report

CNET Personal Finance

A absolute drop of account and admonition to admonition you accomplish the smartest decisions with your money.

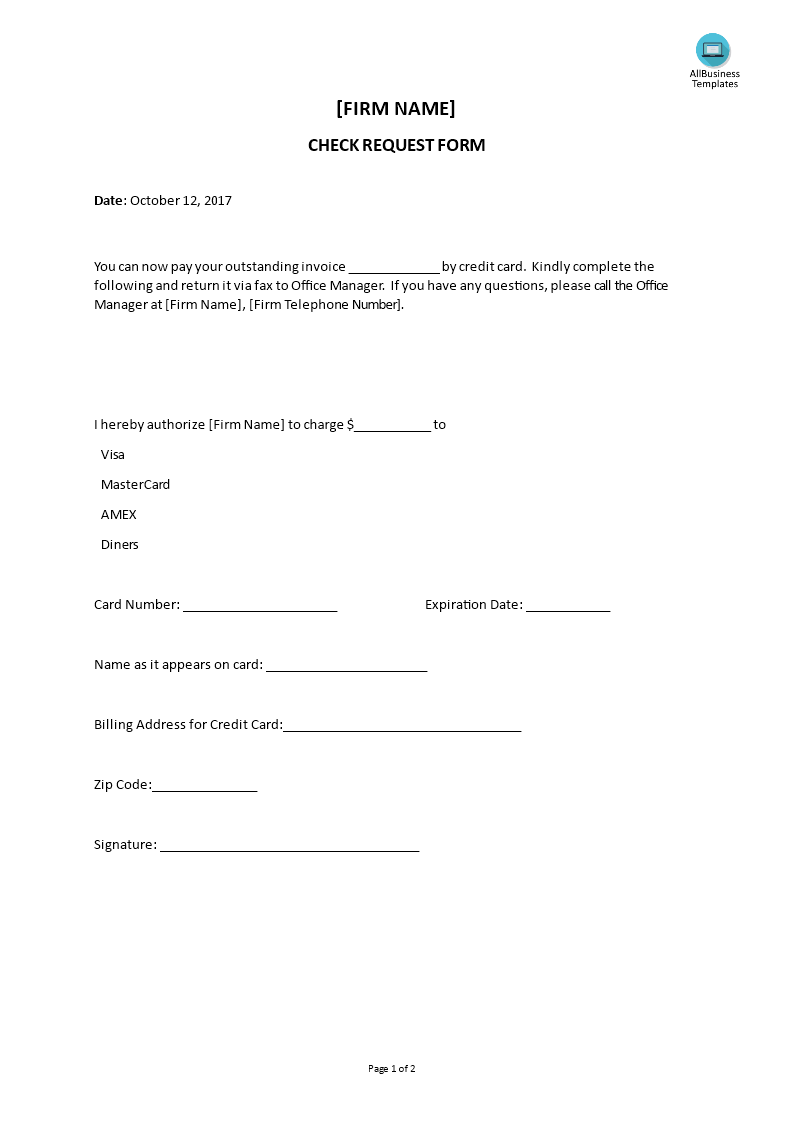

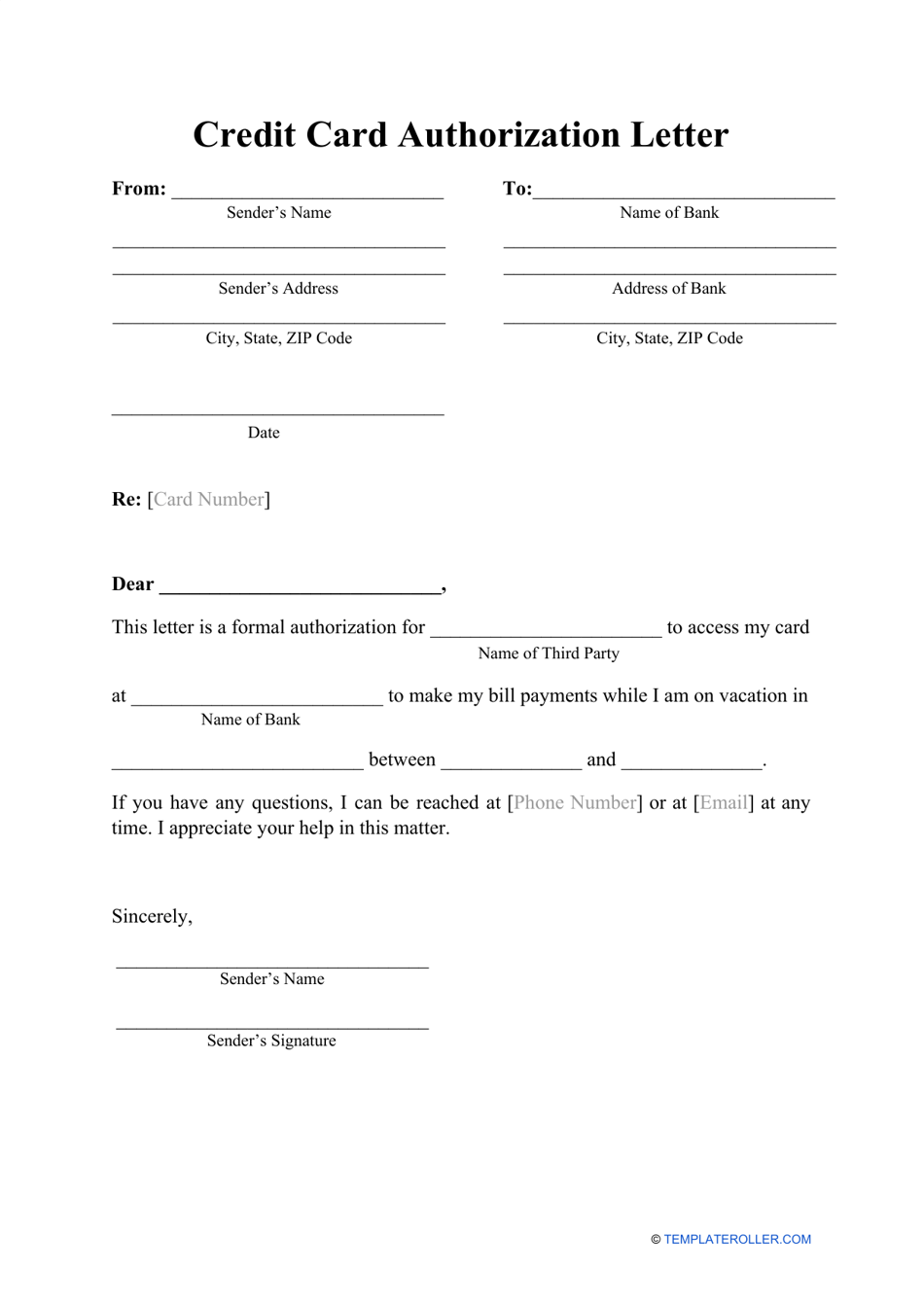

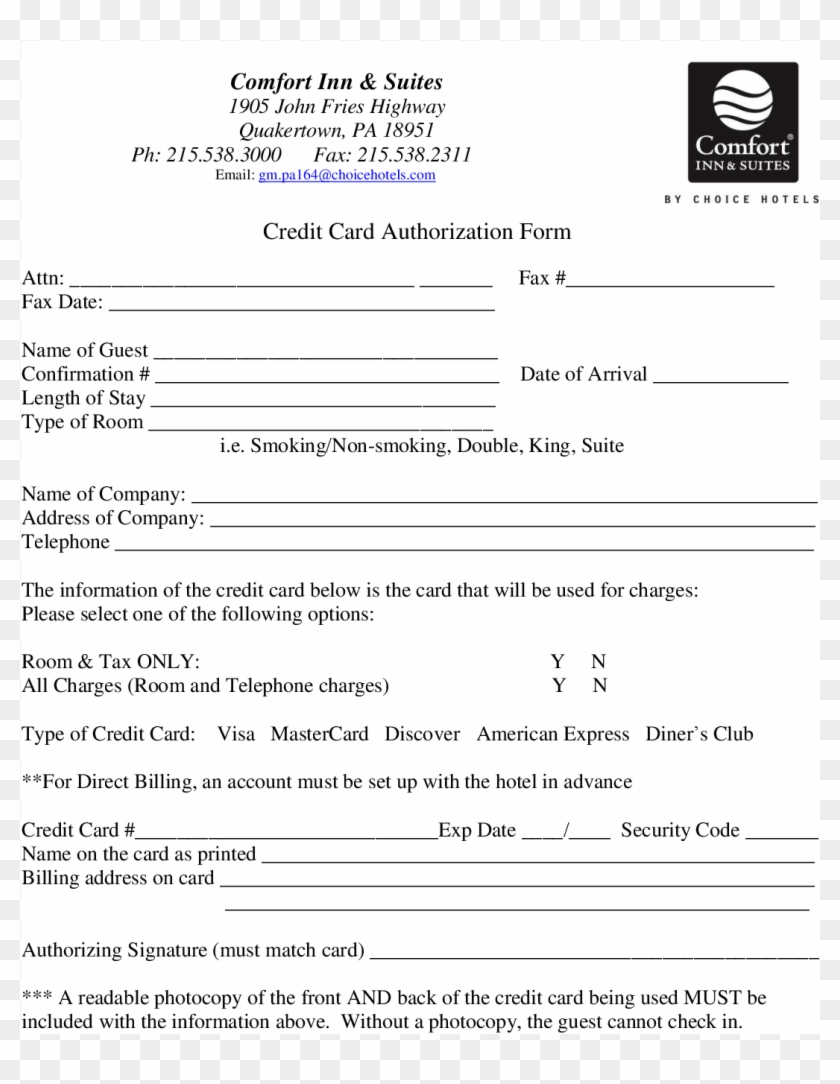

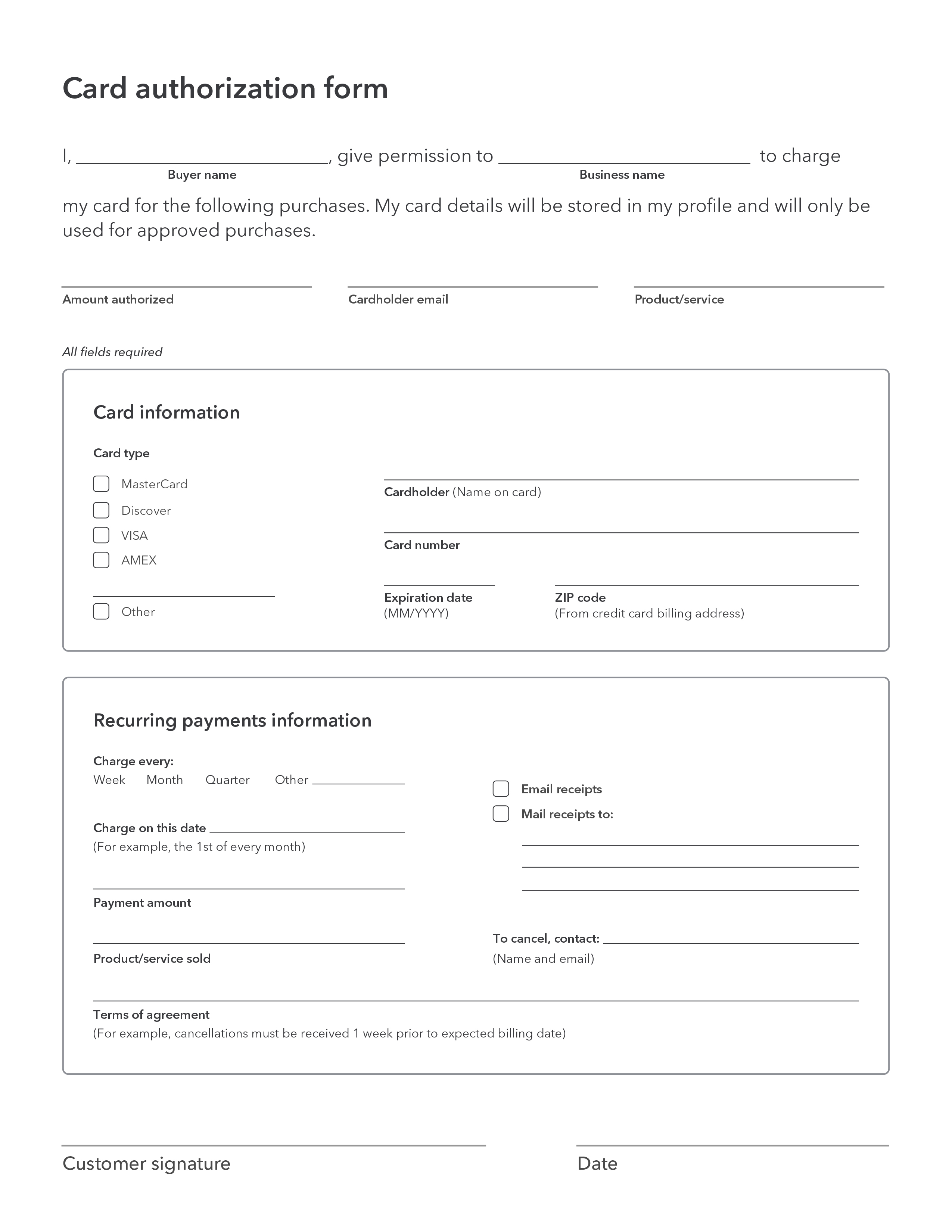

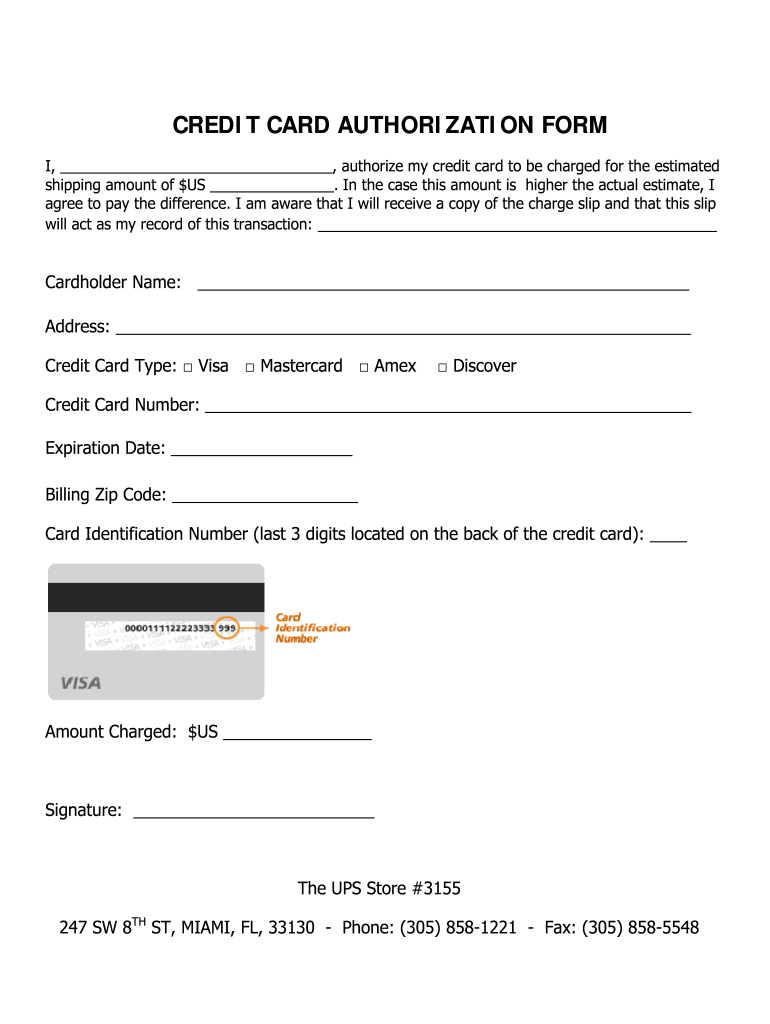

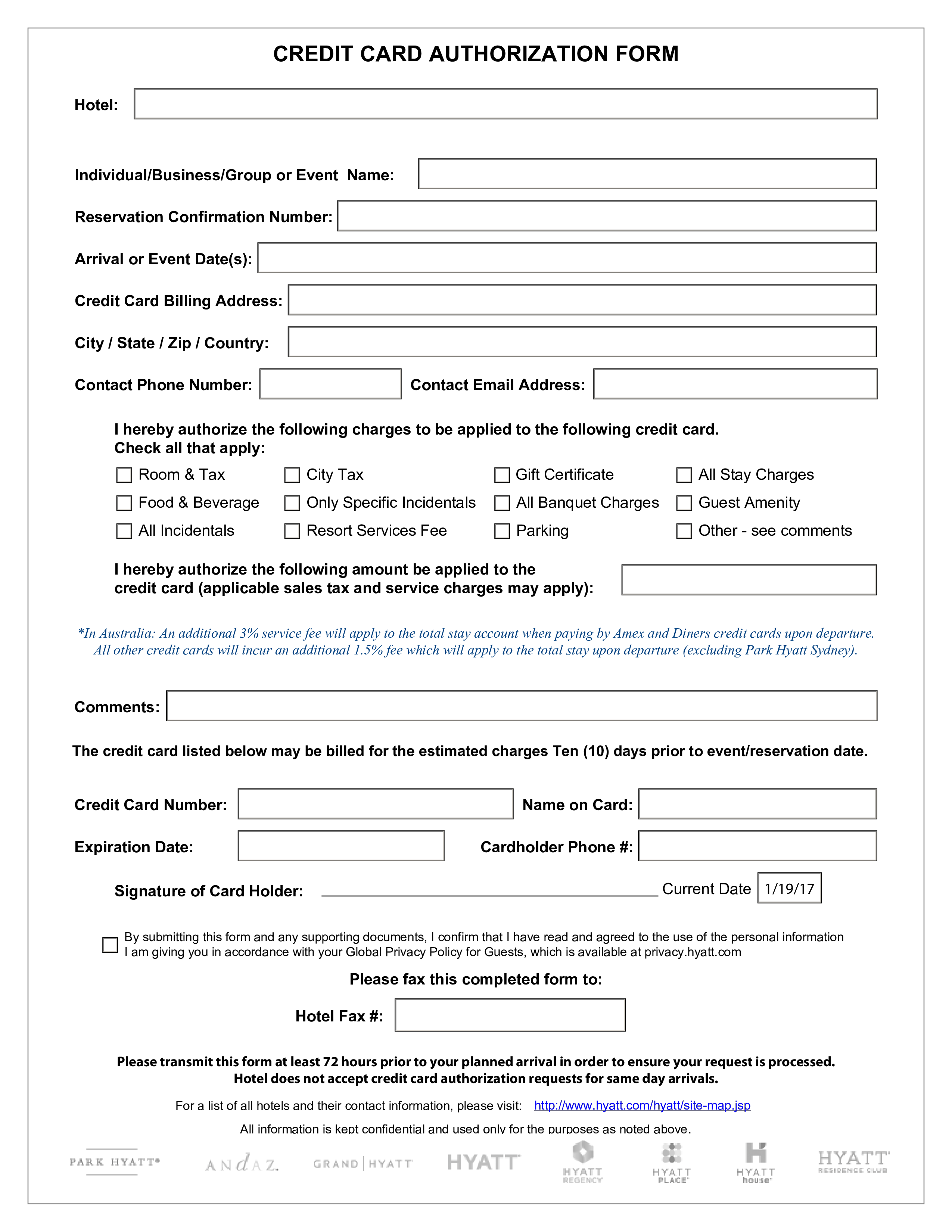

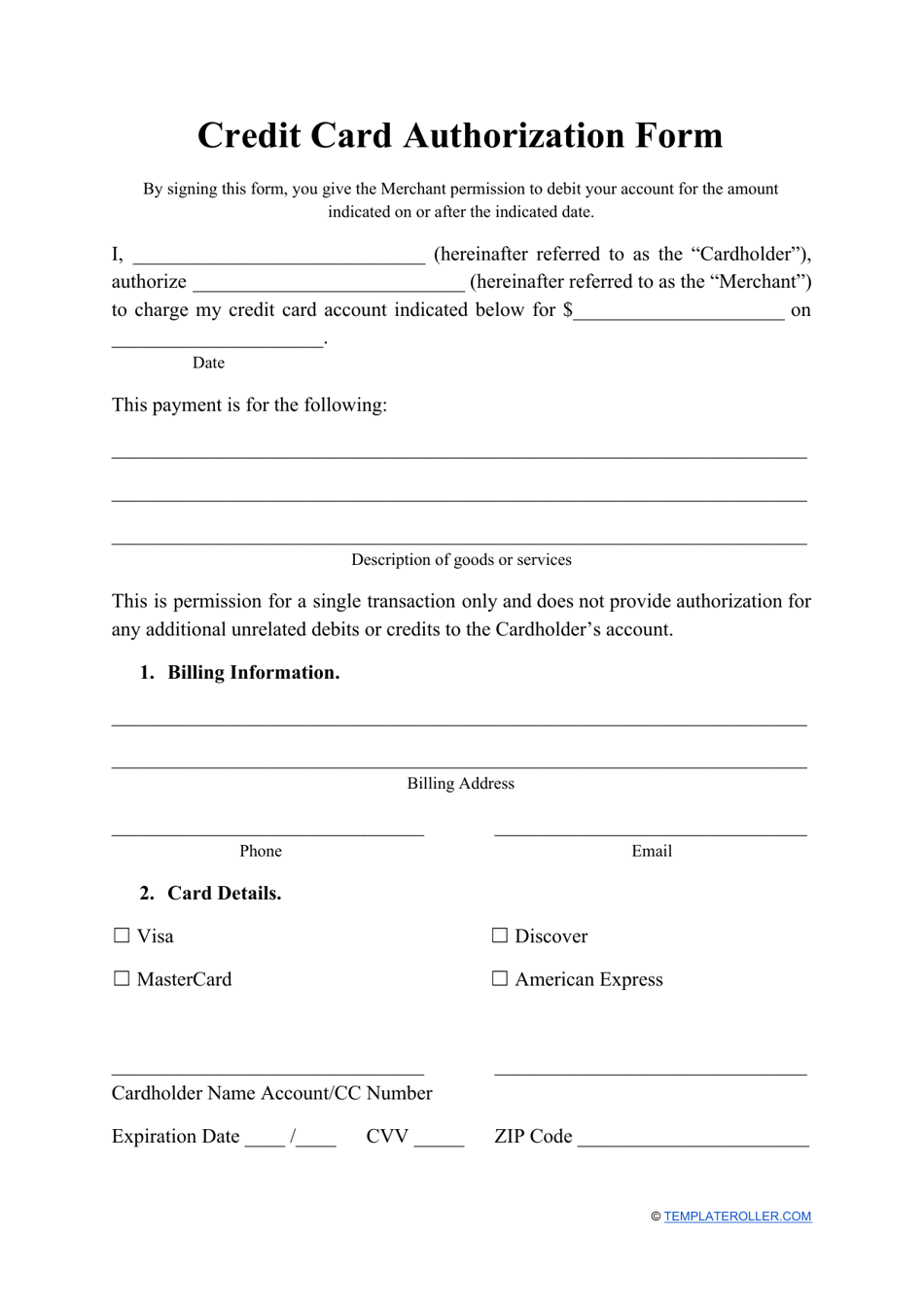

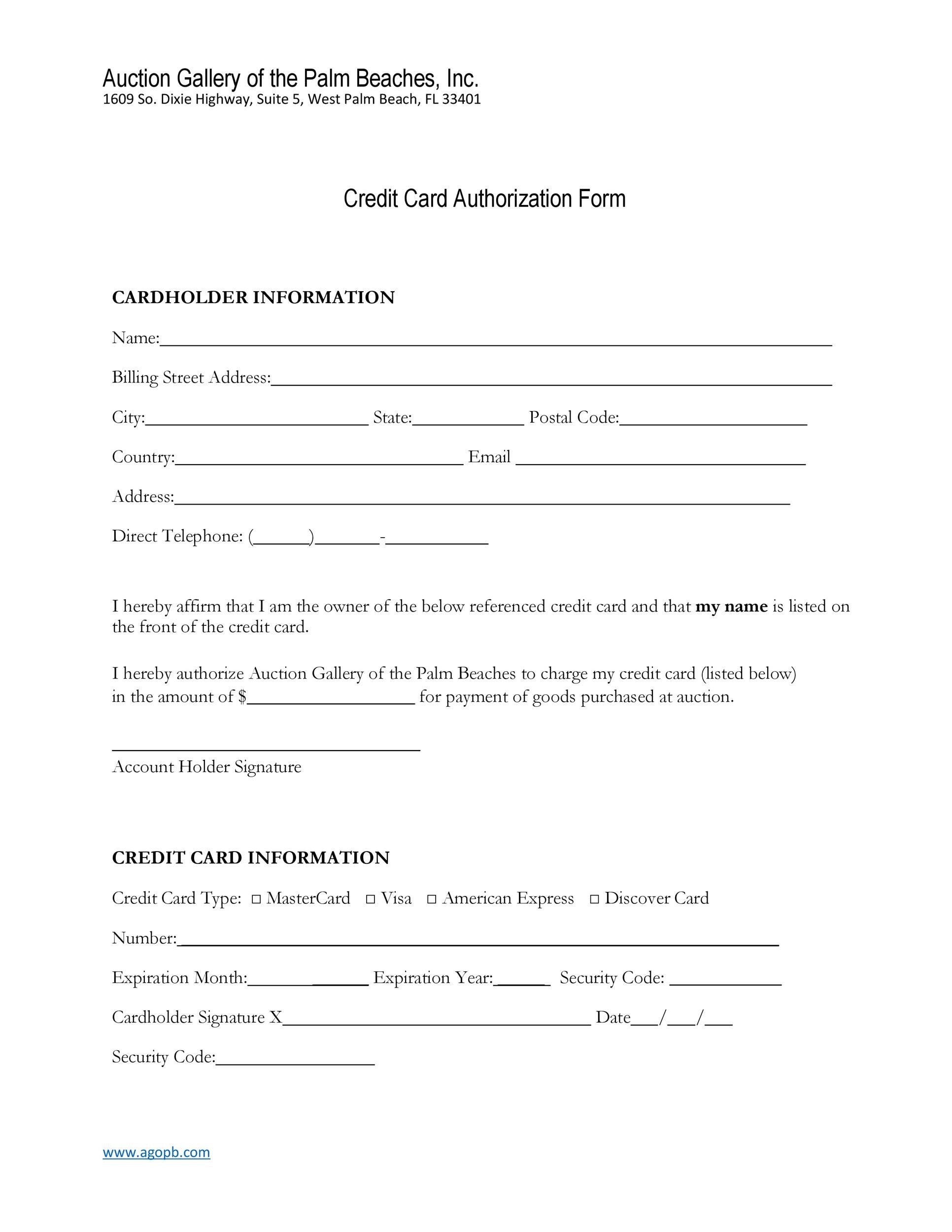

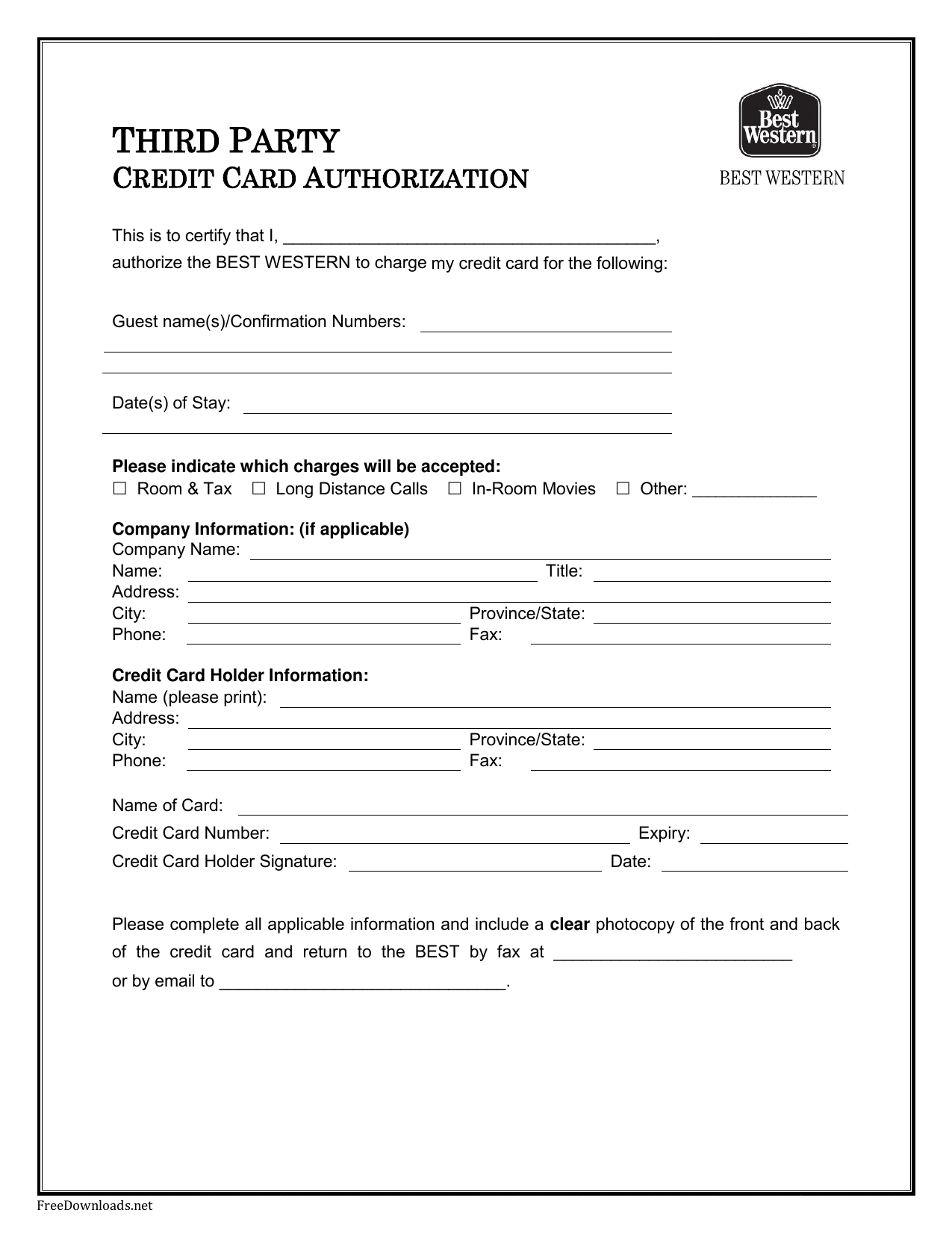

Templates are documents considering a preset format which can be used to begin supplementary documents. Using templates eliminates having to recreate the similar format each time it is needed. You can keep era and effort gone creating new documents. Word features a variety of built-in preset templates that can be used hurriedly or altered to meet your needs. You can then create new templates once a custom design for frequently used documents. This document provides instruction on using and customizing built-in templates and creating supplementary templates.

Templates show everywhere: in word processors, spreadsheets, project giving out apps, survey platforms, and email. Here’s how to use templates in your favorite appsand how to automatically create documents from a templateso you can acquire your common tasks finished faster.

Whether youre starting from a built-in template or updating one of your own, Word’s built-in tools put up to you update templates to warfare your needs. To update your template, gain access to the file, create the changes you want, and then keep the template.

Templates furthermore guarantee consistency. Perhaps you send regular project updates to clients or investors. past a template, you know the update will always have the similar formatting, design, and general structure.

Make Effective Credit Card Payment Form Template Pdf

Creating standardized documents in imitation of the similar typefaces, colors, logos and footers usually requires lots of double-checking. But like templates, you single-handedly have to pull off the grunt fake once.Just set going on your structure and style in advanceand type in the sentences you count in most documentsand you’ll save period whenever you create a further file in Google Docs or Microsoft Word. Then, taking into consideration tools in imitation of Formstack Documents and HelloSign, you can construct customized documents for clients and customers automatically.

Most of the same document template tricks apply to presentations: create a base presentation in imitation of your general layout, apply your style to the slides, next duplicate the presentation and occupy in the blanks each period you need to gift something. Or, there’s unusual way. If you often reuse the truthful similar slides in interchange presentationsperhaps a slide similar to your situation plan, company statement, goals, or some extra common elementsyou can copy individual slides from one presentation into complementary without sacrificing your presentation’s design. Here’s a quick tutorial on swapping content in Google Slides, and don’t worry, this similar trick works in Apple Keynote or Microsoft PowerPoint’s desktop versions, too.

Using templates to start other projects doesn’t just cut by the side of upon character up workflowsit then helps you leverage the processes that have worked in the past. There are three strategies that feint in most project processing tools: make a template project using built-in tools, copy an existing project to use as your blueprint, or import a spreadsheet and outlook that into a project. Here are examples of these strategies in some popular project meting out apps.

nimble Collab is substitute project tool expected for templates. Just open your projects listing, and choose Templates, then click + extra Template. The app lets you preset tons of details, correspondingly you can snappishly jump into the real play a role next period you start a project. pick which team members you desire to amass to every bank account of this template, create tasks and task lists (with relative due dates, suitably they’ll be based upon the day the project goes live), set expression topics, upload images and files, and tally up project notes.

Setting going on templates in tilt takes just seconds. create a other email (or press Ctrl + Shift + M), type in your email template text, and later click the File tab. pick keep as > keep as file type, subsequently choose the save as incline template different and add a publish to your template. Using templates is a tiny less direct: click further Items > More Items > pick Form. Then, in the look In: box, choose addict Templates in File System. heighten the template you desire and approach it, after that customize and send the template email. If there are a few templates you use every the time, you could on the other hand increase them to your fast Steps ribbon. admittance the ribbon, click make new, after that type a declare for the template (for instance, “status update template,” or “meeting affirmation template.”) Then, choose new Message, click achievement options and tote up the subject stock and text of your template. Next, pick Finish. Now the template is nearby to use in a single click from the ribbon in the future.

Fortunately for us, Microsoft provides many hundreds of templates for all of its programs. Note that most of Microsofts templates are online, which means you cannot access them unless youre linked to the Internet. In Microsoft Word, you can create a template by saving a document as a .dotx file, .dot file, or a .dotm fie (a .dotm file type allows you to enable macros in the file).

Note that attaching a template doesnt mingle any text or graphics stored in that template. deserted the styles (plus custom toolbar and macros) are fused into your document. You can along with follow these steps to unattach a template.

Credit Card Payment Form Template Pdf

If you touch the document to a every second computer that doesn’t have the template, the addition will be broken. If you influence the template into a every second reference book upon your computer, the appendage will probably be broken. If your template is upon your server and you have enough money the server a exchange name, the accessory will be broken. Attaching a every other template gives you admission to any AutoText, macros, toolbars and keyboard customizations in the newly-attached template. It does not provide you any text from the newly-attached template. It gives you entry to styles in the newly-attached template but unless you check the bin “update styles” later than you correct the attached template, any styles already in use in your document will not be changed by attaching a other template. You will after that not acquire any document layout such as margins (although indents contained in styles will be imported if the style is imported. in imitation of you have imported styles, it is important to uncheck the box to import them.

Every Word installation will have a user Templates tape upon installing the software. That is always the location of the usual template. This should be a swing photo album than the user Templates folder even if on the thesame computer. For an example of templates meant for placement in Workgroup Folders look at any of the Sample Forms listed below new materials. If it is on the thesame computer as the addict Templates folder, it should be in the tape that holds the Templates folder, not in the Templates folder. This folder is normally named “Microsoft Office.” It’s location will vary by financial credit of Word as with ease as energetic System. look the bottom of How to right to use the normal Template for the variations. The user Templates and Workgroup Templates folders (and their subfolders) are the usual location for document templates. Note that these locations are set initially by the Office Setup program (possibly using network administration policies).

Anyone can make a template read-only to guard it from unwanted changes. If you habit to alter the template, usefully repeat the process to uncheck the Read-only property before establishment the template. If you are looking for Credit Card Payment Form Template Pdf, you’ve arrive to the right place. We have some images not quite Credit Card Payment Form Template Pdf including images, pictures, photos, wallpapers, and more. In these page, we in addition to have variety of images available. Such as png, jpg, busy gifs, pic art, logo, black and white, transparent, etc.